Comprehensive Tax Plan

Minimize Your Tax Liabilities

Clear Wealth Management

Legal Entity Optimization

Tax Facts:

26 of the Wealthiest Billionaires Paid an Effective Tax Rate of 4.8%

93% of Small Businesses are Overpaying on their Taxes.

Without replacing your current CPA, we give you access to Advanced Tax Strategies that the ultra-wealthy use to pay these low rates. They do it, why shouldn't you?

Our software is trained, and constantly updated, on the over 75,000 pages of the US tax codes. This is the tool that our Executive Team uses to prepare your personalized tax saving plan.

When it comes to taxes, everyone wants to pay as little as legally and ethically possible. The ultra-wealthy have access to advanced tax strategies that allow them to pay incredibly low rates.

With ProTax.ai, now you can too. We either find substantial tax savings beyond what your current CPA/Tax person has implemented, or we can't charge you, it's our Guarantee. You've got nothing to lose and 10's of thousands (or more) to gain.

AI-Powered Advanced Tax Savings

Strategic. Personalized. Effective.

Proven Tax Strategies Plus Audit Insurance

our commitment to stand by you

We provide you with extensive documentation and substantiation for every strategy in your plan. Beyond that, our included Audit Insurance has our team standing beside you, should you ever need that for any of the strategies we implement for you.

Start Saving on your

taxes In 3 Easy Steps

Our process is simple and effective.

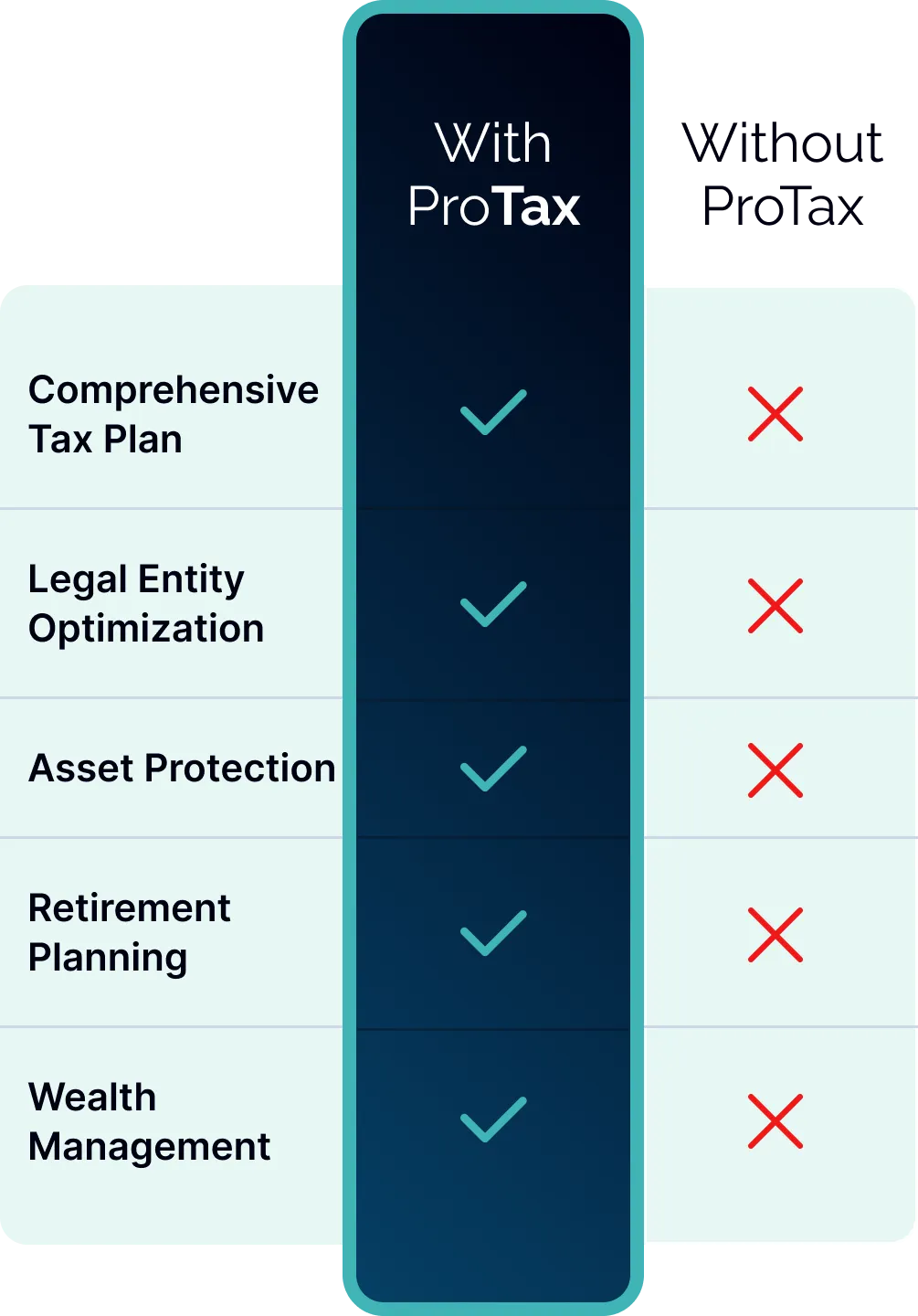

Comprehensive Tax Plan:

We go beyond the basics to create a tax plan that encompasses every aspect of your finances. From smart investment planning to strategic estate management, we ensure every decision is tax-optimized.

⦿ Aligning your investments for optimal tax benefits.

⦿ Designing retirement strategies that balance enjoyment and efficiency.

⦿ Ensuring your legacy and charitable giving are both meaningful and tax-smart.

Legal Entity Optimization:

Asset Protection:

Retirement Planning:

Wealth Management:

Core Strategy:

At the heart of our service is the development and implementation of personalized tax strategies. We consider your entire financial landscape to craft approaches that maximize your tax savings.

⦿ Creating a unique strategy that fits your financial goals.

⦿ Concentrating on strategies that yield the greatest tax savings.

Meet Your Team

Our team works diligently to deliver superior tax preparation,

research, planning, and compliance services.

MICHAEL MOFFA, AIF®, AWMA®,CRPC®, CEPA®

Chairman| Private Wealth Advisor

With over 20 years in wealth management, Mike combines a deep understanding of financial planning with a keen insight into tax law. As a holder of multiple certifications Mike leads our team with a commitment to integrity and excellence.

STEPHANIE VORWIG, MAcc, CPA

Vice President of Client Advisory Services

With over 20 years of experience, her specialty in forensic accounting means she’s skilled at uncovering financial insights that others may miss, which translates into more effective strategies and savings for our clients.

MICHAEL FURDOCK, J.D.

Tax Compliance Attorney

Attorney, entrepreneur, and your proactive tax strategy partner. With a strong background in contract law and tax compliance, Michael brings a practical and results-driven mindset to the ProTax.ai team.

NICK TURNER, CPA, CFP

Lead Tax Director

With over a decade at KPMG Nick has the skills necessary to develop and execute precise tax strategies that deliver real, bottom-line benefits. Trust in Nick and our team to craft a tax plan that works for you.

Here's how we do it...

We will work directly with your CPA to make sure you are paying the lowest amount, legally and ethically possible.

Tax Assessment

Our team becomes your team. We conduct thorough analyses of your tax situation. We perform comprehensive reviews and in-depth assessments to craft tailored strategies which will significantly reduce your tax bill. Our meticulous approach, we ensures that every possible saving is uncovered.

Tax Strategy

Our approach is proactive and predictive. We stay ahead of tax law changes and adapt strategies swiftly to ensure they’re effective and compliant. With ProTax.ai, your tax strategies are always smart, up-to-date, and tailored to maximize your benefits within the bounds of the law.

Tax Implementation

ProTax.ai is hands-on throughout the year. We meet with you quarterly to review your financials, both business and personal, and adjust strategies in real-time. This approach prevents overpayment and maximizes your tax savings every step of the way.

What you get With ProTax

Our smart AI tells you how much

you can save in taxes.

We have helped our Clients

save Millions on their taxes

Frequently Asked Questions

Questions? We’ve got you covered.

I already have a great CPA/Tax person, why would I use you?

Most of our clients have great CPA's. We prefer that you do, it makes our job easier as they can provide the best information about your current tax situation. We will coordinate and work directly with your current CPA.

Here's why you would use us: Your current CPA has taken you to the lowest tax rate they can, but you still owe $50k a year or more. If we can't find savings beyond what they already have, we can't charge you. It's our guarantee.

What do you mean by Audit Insurance?

First, we provide you and your CPA with a complete package for each strategy.

These packages provide you with all of the documentation and substantiation that the IRS should need to see, in an easy to read format.

This assures that, should an audit for one of our strategies ever happen, you only need to send this information and it should stop those questions right in their tracks.

And, should the IRS need more, our Audit Insurance means that we will be there, by your side, defending any and all of our strategies we have implemented with you.

What is this AI tax software, and how does it work?

Our software leverages the power of artificial intelligence to analyze your financial information and provide tailored tax-saving strategies. It has been trained on the entire US tax code. Over 75,000 pages containing over 1,500 strategies, some of which, we will match to your personal situation and present to you substantial savings.

Is my personal and financial information secure when using this software?

Yes, we utilize the industry standard for safe document transfer and storage. Your personal and financial information is safe with us.

Can this software help with both personal and business taxes?

The software is designed to help people with their personal taxes. We can advise you on strategies that are affected by your business, but ultimately, we're going to reduce your personal taxes.

How much can I save using this software?

How much you save depends in a large part on how much you usually pay. Our clients save, on average $30,000 to $50,000, but we've saved clients 100's of thousands and one client saved $2.6 million.

Do I still need to consult a human tax expert in addition to using this software?

Absolutely! This software is a tool that our team of experts use to help them save you on your taxes. Our Executive committee ranges from a former KPMG CPA, to one of our founders with over 20 years in wealth management. We've got tax lawyers and a forensic CPA on the team. So, yes, our team of "humans" is here to make sure you pay the least amount in taxes as legally and ethically possible.

Start your journey to significant tax savings

with ProTax.ai today!

We put Your money back

into Your pocket.